Navigating Estate Administration in Tennessee

Managing the estate of a deceased loved one can be a daunting and emotional task. Estate administration involves a series of legal responsibilities that must be handled with care and precision. At the Law Offices of Crystal Etue, PLLC, we are committed to providing compassionate and expert guidance through every step of the estate administration process in Tennessee.

Understanding Estate Administration

Estate administration is the process of managing and distributing a deceased person’s assets in accordance with their will or, if no will exists, according to state law. This process involves several critical steps, including:

- Probate: This is the legal process by which a will is validated by the court. If there is no will, the estate will be distributed according to Tennessee’s intestacy laws.

- Appointment of Executor/Administrator: If a will names an executor, this person is responsible for administering the estate. If there is no will, the court will appoint an administrator.

- Inventory and Appraisal of Assets: The executor or administrator must identify, inventory, and appraise the deceased’s assets. This includes real estate, personal property, bank accounts, investments, and any other assets.

- Payment of Debts and Taxes: The estate is responsible for paying any outstanding debts and taxes owed by the deceased. This includes federal and state taxes, as well as any debts to creditors.

- Distribution of Assets: Once all debts and taxes have been paid, the remaining assets are distributed to the beneficiaries as outlined in the will or according to state law if no will exists.

Key Responsibilities of an Executor/Administrator

The role of an executor or administrator comes with significant responsibilities, including:

- Fiduciary Duty: The executor or administrator must act in the best interests of the beneficiaries and manage the estate with care and integrity.

- Communication: Keeping beneficiaries informed about the status of the estate and any decisions made during the administration process.

- Record Keeping: Maintaining accurate records of all transactions, including receipts, payments, and distributions.

- Legal Compliance: Ensuring that all actions taken are in compliance with Tennessee law and any applicable federal laws.

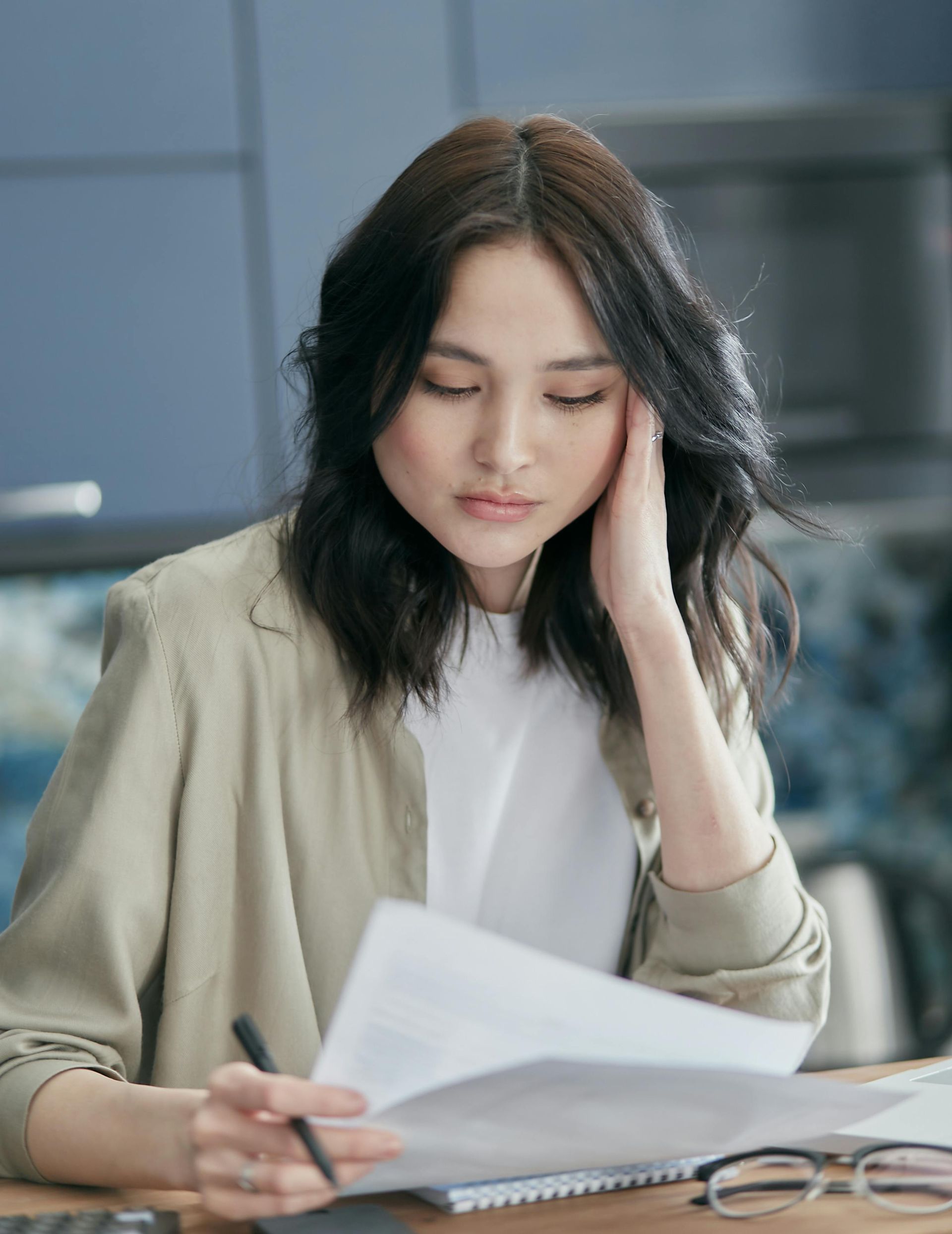

Challenges in Estate Administration

Estate administration can be complex and challenging, especially if there are disputes among beneficiaries or creditors, or if the estate includes unusual assets. Common challenges include:

- Disputes Among Beneficiaries: Conflicts can arise over the distribution of assets, the interpretation of the will, or other matters. These disputes can delay the administration process and may require legal intervention.

- Complex Assets: Estates that include businesses, investment properties, or other complex assets require careful management and valuation.

- Tax Issues: Navigating federal and state tax requirements can be complicated and requires careful planning to minimize tax liability.

How the Law Offices of Crystal Etue, PLLC Can Help

At the Law Offices of Crystal Etue, PLLC, we understand the emotional and legal complexities involved in estate administration. Our dedicated team offers:

- Comprehensive Legal Support: We guide you through the probate process, ensuring all legal requirements are met.

- Expert Advice: We provide expert advice on managing and distributing estate assets, resolving disputes, and handling tax issues.

- Compassionate Service: We approach every case with compassion, understanding the emotional toll that estate administration can take on families.

- Efficient Solutions: We strive to make the process as smooth and efficient as possible, minimizing delays and ensuring a timely resolution.

Estate administration is a crucial responsibility that requires careful attention to detail and a thorough understanding of Tennessee law. The Law Offices of Crystal Etue, PLLC, is here to provide the guidance and support you need during this challenging time. If you are facing the task of administering an estate, contact us today for a consultation. Let us help you navigate the complexities of estate administration with confidence and peace of mind.